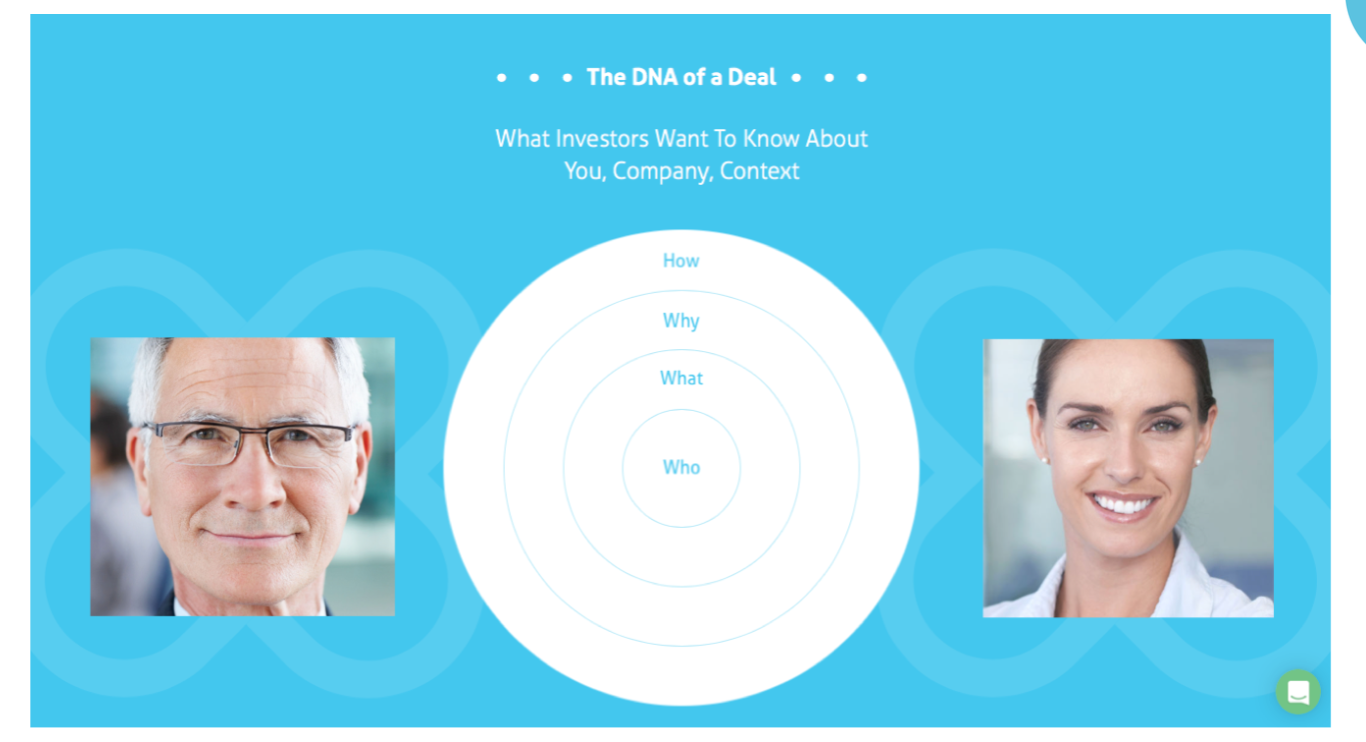

Get inside their heads, so you can better answer their questions!If you're new to the funding game, you'll probably be curious about what investors actually look for in a company before they invest. Or if you've already had some investor meetings, maybe some of these things will ring true for you and bring you some additional insights?

Key things to remember about your interactions with investors:

So now that we've gotten all that out of the way, let's dive into the key information they need to know about you and your business, before deciding to go further. WHO:

WHAT:

WHY:

HOW:

These are just some of the key things you can be sure that potential investors will want to know, before investing in you. You'll get asked these questions and more throughout the whole funding process, so best be prepared to answer them all. It's always good to get advice from other founders who've raised money before you and also to ask for straight answers from investors - are they going to invest Yes/NO?, are they really interested in your company. Once you can cover all these questions, you'll be in a great place to have constructive conversations with potential investors and to tell your 'funding opportunity' story effectively. Above all, remember they are investing in your investment opportunity, not your product or service, so don't get too focused on your product demo or key features. Show them how you'll be a great fit for their fund, portfolio and try to get a straight answer Yes or No answer from them (to whether they will invest or not) as soon as you can. If it's a 'no', that's ok too, get it quickly and move on to the next investor on your targeted list! Any other points you'd like to add to our list? Let us know in the comments below! Now, go get ready for your next investor meeting!

0 Comments

Funding Must ReadsLooking for funding can be a daunting and complex process, with many pitfalls to avoid. The good news is that you really don't have to reinvent the wheel - there is a lot of expert advice out there, from investors sharing their key tips and advice as well as from founders who've successfully navigated their own fundraise. We've curated our favourite Books and Blogs (in no particular order) to help you decide which ones are worth some of your very precious time! 1) BooksOn Venture Capital, Corporate VC and Private Equity:

On Corporate Venture Capital and Private Equity

On Angel Investing:

General Books about the Fundraising Process On Due Diligence, Term Sheets, Valuations and Cap Tables - Get Ready to Negotiate Time to get into the 'nitty-gritty' detail of the negotiation and signing phases of raising funding - learn what you need to know from these great books!

|

About Global Invest HerWe Are On a Mission to Help Fund 1 Million Women Entrepreneurs by 2030. Archives

September 2021

Categories |

Community Changes EverythingWe partner with global investors, organisations and founders, to bring community, funding knowledge and skills to women entrepreneurs

|

Connect With Us |

Learn with Us |

|

Copyright Global Invest Her 2022 - All Rights Reserved

|

RSS Feed

RSS Feed